Question for you: Which distinctly British asset class has offered the most attractive returns over the past decade? Central London property? Not even close, even if it has done rather well. UK farmland is the answer, having more than tripled in?value?over a decade which will otherwise not be remembered for its outsized returns (see story?here). The rise in farmland values is not only a British phenomenon. All over Northern Europe and North America farmland values have responded well to higher commodity prices. Last year alone, farmland prices in the US Midwest appreciated by 22% on average (details?here).

Now, if ?rental income? on farm land is going up as measured by higher crop prices, it is only logical that the value of the land appreciates, similar to the dynamics in the commercial property sector. However, I have long been puzzled by the fact that you find virtually no exposure to farm land in institutional portfolios despite the supremely attractive yields on offer when compared to commercial property. Pension funds happily buy office buildings, earning a return of 4-5%, maybe 6%, yet few have ventured into farmland where yields can be as high as 10% if the farm is big enough and run professionally enough.

In this month?s Absolute Return Letter we will take a closer look at agriculture. Should you be exposed to agriculture in the first place? Is it too late to buy farm land? Are there other and better ways to be exposed to agriculture? These and other questions I will address in the following.

Let?s begin with some numbers to set the stage. There are approximately 7 billion people in the world today. FAO (the food and agriculture organisation of the United Nations) expects that number to grow to approximately 8.3 billion by 2030. The average person consumes 2,780 kcal per day but the average masks a significant gap between the developed and the developing world. Whereas people in developed countries consume 3,420 kcal per day, people in developing countries consume no more than 2,630 kcal per day. By 2030 the average calorie intake is expected to have risen to 3,050 kcal per day, driven primarily by rising living standards in developing countries.

Adding these numbers up, global daily calorie consumption is approximately 19.5 trillion kcal, growing to an estimated 25.3 trillion kcal by 2030 ? an increase of about 30%. An increase of that magnitude should, on its own, be quite manageable; however, things are not quite so straightforward. Here is the problem. Whereas diets in developing countries consist primarily of grains (rice, corn, wheat, etc.), diets in the wealthier parts of the world are dominated by protein, fat and sugar.

As the poor get wealthier, they will want more protein ? mainly chicken, pork and beef. Converting a grain rich diet to a more protein rich diet will?increaseoverall demand for grain significantly as livestock is inefficient in terms of converting grain to energy. It takes 2-3 kilograms of grain to produce 1 kilogram of chicken, about 4 kilograms of grain to produce 1 kilogram of pork and as much as 7-8 kilograms of grain to produce 1 kilogram of beef. Hence, if the average daily calorie?consumption grows by 30% between now and 2030 as projected, demand for grain will grow by a multiple of that.

In other words, the ag story is very much a story about rising living standards. The world produces increased spending power at an unprecedented scale. During its own industrial revolution in the late 18th?and early 19th?century, it took the United Kingdom no less than 154 years to double its per capita GDP. It has taken China a mere 12 years to accomplish the same. The OECD projects that the global middle classes will increase by 3 billion people over the next 20 years. These people will want their fair share of protein. This is likely to put unparalleled pressure on both livestock and grain prices.

Chart 1:? Chinese Urban Food Expenditures Outstrip Rural Expenditures (per capita ? RMB thousands)

Source: ?The China Files?, Morgan Stanley, October 2011.

Let?s focus on China for a moment. China?s transition from developing to developed country is already in full bloom and thus offers some excellent insight into the effect it has on natural resources. China industrial revolution began in earnest about 20 years ago. Since then, there has been massive migration from rural districts to urban areas. Chart 1, courtesy of Morgan Stanley, suggests that people in urban parts of China spend 2.7 times more on food items than those living in rural parts of the country. While some of the difference can undoubtedly be explained by higher prices in the cities, the bulk of the difference is down to the higher living standards that come with urbanisation.

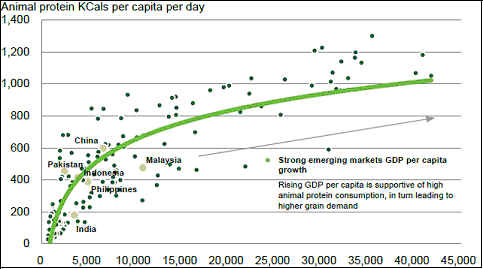

It is not so much that the Chinese eat more when they move to the cities. It is rather the composition of their diets which changes. They simply consume more animal proteins. Between 1994 and 2009, the Chinese effectively doubled their meat consumption from about 35 kilograms per annum to approximately 70 kilograms[1]. Despite this rapid increase, as you can see from chart 2, the Chinese are nowhere near the top of the league tables in terms of animal protein consumption. The United States, New Zealand and Australia are the heaviest meat eaters in the world with an average annual per capita consumption of about 110 kilograms. For comparison, the average EU consumer downs about 80 kilograms of protein per year.

Chart 2:? Animal Protein Consumption Driven by Growth in GDP

Source: Laguna Bay Pastoral Company, Australian Farm Institute

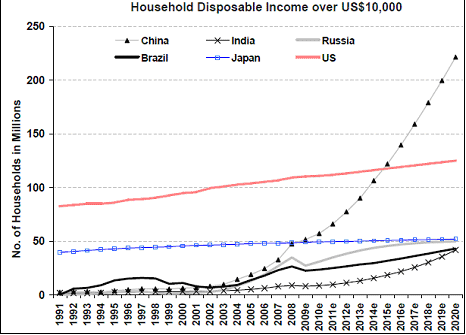

Within a few years China will have more middle class families than the United States (chart 3). Analysts tend to focus on what that means for the car industry, for energy, steel, cement and copper prices. Few talk about agriculture but the implications are likely to be dramatic. I have written before about human ingenuity (see?here) and my views remain unchanged. Many new technologies are in the pipeline, some only a few years away.

Some of these new technologies are likely to transform the use of many raw materials; however, food is a commodity where only limited technological progress has been made. Scientists have had some success with drought resistant crops which should improve yields meaningfully and genetically modified food will, whether we like it or not, gain some traction in years to come, but I have seen nothing that suggests to me that some groundbreaking new technology will revolutionise farming any time soon.

Chart 3:? Expect Rapidly Rising Living Standards in China

Source: Morgan Stanley, Commodities Outlook, November 2011

The Chinese leadership has long considered food self-sufficiency as a matter of national security and has allocated considerable resources to maintain its self-reliance. It worked for a while but the Chinese are running out of the two main resources required to remain self-sufficient ? land and water. The ongoing urbanisation of China causes more and more cropland to be lost to city dwellers. Obviously rising yields can to some degree offset those losses, but China increasingly finds itself a buyer of grains in international markets.

Water is the second major constraint with China having to feed 20% of the world?s population on 6% of its fresh water. The average Chinese has only about 2,100 cubic metres of fresh water at his disposal every year ? less than one-third of the global average ? and a growing percentage of it is allocated to industrial companies. According to the World Bank, the water shortage is likely to get a?great?deal?worse as there is evidence of excessive ground water depletion in many parts of China. In some areas around Beijing, ground water tables have dropped by as much as 300 metres.

For all these reasons there is only one probable outcome and that is for China to import a growing percentage of the food it will need to satisfy the changing dietary habits of its population. South Korea offers some interesting insight into what China may look like 10-15 years from now. The Chinese consume virtually the same number of calories as the South Koreans ? about 3,000 kcal per day ? but whereas the Chinese diet is still grain rich and low on fat and sugar (they should try and keep it that way!) ? the Koreans have increasingly adopted a Western lifestyle. If the Chinese were to consume the same amount of chicken, pork and beef as the South Koreans, and they almost certainly will eventually, Chinese meat consumption would increase by 5.5 billion pounds ? up 8% from today?s levels. The biggest effect would be on chicken meat. An increase to Korean consumption levels would result in a rise in global demand for chicken meat of no less than 10%.

According to estimates from Morgan Stanley, a full 70% of China?s corn produce and about 14% of its wheat already goes towards feeding the livestock industry. As the Chinese stuff themselves with ever more meat, only the world?s largest grain exporters are big enough to deliver on the scale the Chinese will need. It will be countries such as Argentina, the United States, Russia and Australia that are likely to benefit from the Chinese protein feast.

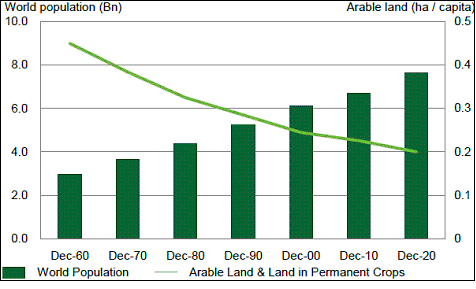

Chart 4:? Arable Land is Shrinking as World Population Continues to Grow??

Source: Laguna Bay Pastoral Company

I haven?t even touched on the rest of the world yet. China may deliver a large chunk of the 3 billion new middle class consumers the OECD projects for the next 20 years, but people all over the world will want to climb the protein ladder. This will happen at a time where the amount of land available for agricultural use is under more pressure than ever before (chart 4). Urbanisation is a global phenomenon and arable land is lost every day of the year to a growing number of people who opt to live in urban areas.

FAO estimates that global demand for meat will grow by 23% over the next decade as a result of a rising number of people with enough purchasing power to afford animal protein. With less and less land available, there will be considerable pressure on grain producers to deliver the amount required to feed the extra livestock.

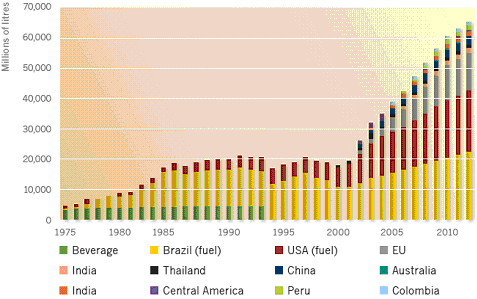

The bio fuel madness?Finally, a word on bio fuels. If your brain works broadly like mine, you probably wonder what went through the heads of those law makers who came up with the rather daft idea of creating a grain based bio fuel industry (chart 5). It is a sad testament to the weakness of modern day democracy where the elected simply bribe their way to longevity. Having said that, I do not for one second expect our political leadership to do a u-turn on bio fuels, however rational such a move might be. Hence, for many years to come, consumers all over the world will have to compete with American gas guzzlers for the next corn on the cob.

Chart 5:? Global Ethanol Production

Source: Global Green Agriculture

Now, let?s look at the investment implications of all of this. The answer to the first question I raised ? should investors be exposed to agriculture in the first place? ? is an unequivocal ?YES?. Arable land is a finite resource and so is water. Demand on existing resources will be immense over the next few decades as living standards increase around the world. In the long run it is?very hard?to be pessimistic on grain prices.

So, if it is such a great story, why is that so few are exposed to agriculture? Maybe it is because of the complex nature of trading futures (managing contango versus backwardation and the cost of carry associated with it); maybe it is down to the inherently cyclical nature of agricultural commodities. Farmers are notorious for chasing returns. In practice this means that, following a season or two of, say, strong wheat prices, every farmer and his mother will want to grow wheat, which will lead to a temporary oversupply of wheat and thus weak prices.

There is also a risk that financial investors have overwhelmed what is in fact quite a small market. If financial investors outnumber fundamental investors, when we go from risk-on to risk-off (a phenomenon I have discussed extensively in previous letters), it has the potential to derail ag prices in the short to medium term. However, if you can stomach the cyclical nature of this asset class, I find it hard to envisage an environment where the returns do not comfortably outpace returns on bonds and equities when looked upon over the next 5-10 years.

If you manage pension money, can take a 10 year view and have no quarrels about the relatively illiquid nature of farmland, that?s where I would be putting my money. Importantly, farm land prices do not need to appreciate for this to be a good investment. The best farmers in Australia generate cash returns in excess of 10% at current crop prices and we hear anecdotal reports of 25-30% annual returns in some countries in Africa. That is obviously very attractive when compared to more traditional commercial property investments. We are currently assessing one such opportunity in Australia. Let us know if you wish to learn more.

If liquidity is important to you, I suggest you consider a relative value approach. Agriculture is particularly suited to relative value strategies because of the large relative price moves between different crops. We are aware of one or two excellent managers in this particular corner of the market. Again, let us know if you are interested. Alternatively, you can invest in managed futures strategies; however their exposure to agriculture varies enormously from strategy to strategy so you need to do your home work.

If you insist on managing the exposure to agriculture yourself, don?t be a hero. Stick to a portfolio of listed securities which is likely to serve you well over the next 10 years. Focus on providers of machinery and fertilizers as you don?t run the risk of betting on the wrong crop.

One final word on cyclicality.?All?commodities are at risk if the global economy weakens substantially. Many investors suspect that the current upswing in the US economy will prove a fluke and that the Americans will be flirting with recession later this year (I don?t). An even bigger number of investors expect the economic landscape to deteriorate further in Europe as 2012 progresses (I don?t). If they are right and I am wrong, you could see a major sell-off in all risk assets, including agricultural commodities.

I will be in Singapore during the period 28-30 March and am available for meetings, should you wish to discuss this or any of our other investment themes.

This post appeared on Pragmatic Capitalism.

Source: http://www.businessinsider.com/the-case-for-agriculture-as-the-next-big-asset-class-2012-3

duggars j r martinez j r martinez long island serial killer wizard of oz jeff green saturday night live

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.